Beyond Index Funds

How Direct Indexing and AQR Flex Strategies May Unlock Tax Efficiency and After-Tax Alpha

Introduction: The Evolution of Index Investing

Over the past several decades, investors have witnessed a steady evolution in how portfolios are built and managed. From actively managed mutual funds to low-cost exchange-traded funds (ETFs), the goal has consistently been to improve efficiency, control costs, and capture broad market returns.

Today, that evolution has taken another step forward with Direct Indexing, an approach that allows investors to own the individual stocks that make up an index, rather than simply owning shares of the index fund itself. This subtle change introduces a powerful advantage: the ability to manage taxes at the individual-security level.

Now, institutional managers such as AQR (Applied Quantitative Research) have introduced next-generation strategies that integrate Direct Indexing with market-neutral overlays and long-short techniques to expand loss-harvesting opportunities. The result: a structure that may generate incremental “tax alpha”—the added value that comes from tax-efficient management, while maintaining the risk and return characteristics of a traditional index.

What Is Direct Indexing?

Direct Indexing replicates the performance of a broad market index, such as the S&P 500 or Russell 1000, by owning each of its individual stocks directly within a taxable account. Instead of buying an ETF that holds those securities collectively, investors hold them separately, enabling precise control over when each stock is bought or sold.

This creates opportunities for tax-loss harvesting. When certain holdings within the index decline, those stocks can be sold to realize losses, which may be used to offset gains elsewhere. The proceeds are reinvested in similar securities to maintain exposure to the index.

Even in strong market years, there are often dozens or even hundreds of positions within an index that decline. For example, in 2024 the Russell 1000 gained +24.51%, yet 34% of its underlying stocks finished the year negative. Direct Indexing allows investors to harvest those individual losses while staying fully invested in the market, much like a real estate owner who depreciates their property while its overall value appreciates.

Introducing AQR Flex Strategies

AQR’s Flex strategies extend the benefits of Direct Indexing through a market-neutral long-short overlay. Each portfolio begins with a traditional, index-tracking base, then adds a carefully calibrated layer of long and short positions designed to increase the number of securities that can generate realized losses.

In a $1 million portfolio using Flex 145, AQR adds a $450,000 long extension (buying stocks the model favors) and a ($450,000) short extension (short selling those it disfavors). The net result is market-neutral, meaning the portfolio’s exposure to broad market movements (beta) remains largely unchanged, while its flexibility to realize tax losses increases substantially.

Because the long-short overlay increases the total number of securities traded, the strategy creates more loss-harvesting “touchpoints,” even in rising markets. The additional leverage typically adds about ±1.5% tracking error relative to the benchmark, within a range many investors find acceptable given the potential for improved after-tax outcomes.

How Tax Alpha Is Created

Traditional index funds or ETFs are efficient for costs but inflexible for taxes. Gains and losses are realized at the fund level, not the investor level. Direct Indexing and AQR Flex strategies unlock individual control, enabling the realization of losses when available and the deferral of gains when advantageous.

AQR’s long-short component further enhances this dynamic. Short positions, by definition, can generate losses in markets that are flat or rising, providing tax-loss realization opportunities in nearly all environments. Over time, this can create a persistent after-tax benefit without materially changing expected returns or risk characteristics.

| Strategy Type | Tax-Loss Harvesting | Customization | Typical Cost | Estimated Pre-Tax Alpha* | |

| Index ETF | None (pooled) | Low | 0.05%–0.25% | 0% | |

| Direct Indexing | Moderate | High | 0.35%–0.70% | 0.5%–1.5% | |

| AQR Flex Strategy | High (long/short overlay) | High | 1%–2.7% | 0.8%–3.3% + tax savings |

*AQR estimates pre-tax alpha net of stated fees and leverage costs.

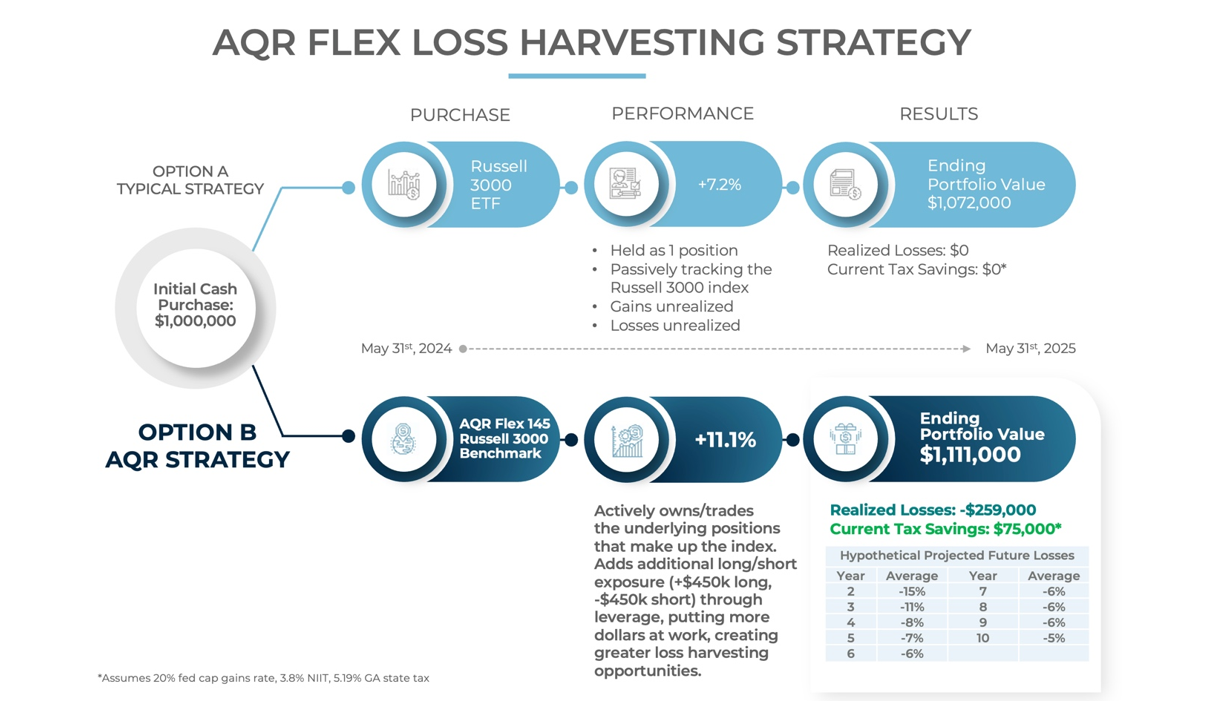

Visual Example: Comparing Approaches to Index Exposure

To see how structure can influence outcomes, consider the difference between holding a traditional index ETF and implementing an AQR Flex strategy over the same one-year period. Both begin with a $1,000,000 investment tracking the Russell 3000 Index.

While the ETF simply mirrors the index’s return, with no realized losses to offset gains, the AQR Flex 145 strategy actively trades underlying positions and employs a long-short overlay, creating opportunities to harvest losses and enhance after-tax results.

(See illustration below for a hypothetical comparison of results.)

Potential Tax Benefits

The chart compares a $1,000,000 investment in a Russell 3000 ETF versus an AQR Flex 145 strategy from May 31, 2024, to May 31, 2025.

Option A (ETF) results in a $1,072,000 portfolio with no realized losses, while Option B (AQR Flex 145) results in a $1,111,000 portfolio with $259,000 in realized losses and approximately $75,000 in current tax savings.Assumes a 20% federal capital gains rate, 3.8% NIIT, and 5.19% GA state tax rate. Hypothetical and for illustrative purposes only.

As illustrated, the ability to realize losses even in positive market years may lead to more efficient after-tax outcomes, especially for investors holding substantial taxable assets or concentrated positions

Case Studies (For Illustrative Purposes Only)

Case Study 1: Diversifying a Concentrated Position

“Lisa,” a long-time executive at a large-cap technology company, holds $3 million of company stock with a very low-cost basis. She wishes to diversify but is hesitant to trigger significant capital gains.

By transitioning into an AQR Flex 145 portfolio through a Direct Indexing framework, Lisa is able to sell portions of her concentrated position over time while realizing offsetting losses in the Flex portfolio. The strategy allows her to maintain full market exposure, reduce single-stock risk, and defer taxable gains. Over time, Lisa transitions into a diversified equity portfolio in a more tax-conscious manner.

Case Study 2: Planning After a Liquidity Event

“Michael,” a business owner who recently sold his company, plans to invest $3 million of the proceeds in equities. Concerned about entering the market after a strong rally, he chooses AQR Flex 200.

The long-short overlay keeps his portfolio near-neutral to overall market movements while generating losses across hundreds of individual positions. These realized losses can offset gains from the sale of his business, helping to manage his near-term tax liability. As markets fluctuate, the Flex strategy maintains diversification and potential tax benefits without increasing his exposure to market risk.

Practical Implementation and Considerations

Funding options:

Investors can fund with cash, securities, ETFs, or mutual funds. Funding with cash provides the greatest flexibility for loss generation, but transferring appreciated positions can also be beneficial for those seeking to gradually divest from low-basis holdings.

Liquidity and unwinding:

The leverage overlay can be unwound gradually, typically over 12 to 36 months, allowing for both tax-conscious and market-conscious exits.

Integrating with broader planning:

Appreciated holdings that remain may serve other strategic purposes, such as charitable giving (via Donor-Advised Funds), estate planning (select assets for step-up in basis at death), or targeted gifting strategies.

Costs and minimums:

AQR Flex management fees range from roughly 0.4% – 1.5%, with total all-in costs (including trading and leverage) around 1.0% – 2.7%, depending on the chosen strategy. Minimum investment sizes begin at $1 million for Flex 145, with higher thresholds for more leveraged versions.

Who may benefit:

This approach can be appropriate for investors with:

- Significant taxable assets

- Upcoming liquidity events (business sale, real estate transaction)

- Concentrated or low-basis stock positions

- A desire to enhance after-tax outcomes while maintaining equity exposure

Key Takeaways

Direct Indexing represents the next generation of index investing, one that emphasizes personalization and tax efficiency over pure passive replication. AQR’s Flex strategies expand that framework further, providing tools to realize losses in a variety of market conditions and potentially improve long-term after-tax outcomes.

For investors and families seeking a more tailored, tax-aware approach to equity investing, these strategies may serve as a valuable addition to a broader financial plan, particularly when integrated with charitable, estate, and liquidity planning.

If you would like more information about the terms and strategies discussed in this guide, or if you’re ready to explore how they apply to your specific situation, contact Waverly Advisors. At Waverly Advisors, we work with clients to craft customized estate plans that help minimize tax exposure, maximize wealth transfer efficiency, and ensure financial security for future generations. Whether your goal is to pass down a business, protect an investment portfolio, or establish a charitable legacy, our team can develop a plan tailored to your needs.

MEET THE AUTHOR

Jim Brown, CFA®, MBA

Senior Investment Strategist

Jim Brown joined Waverly Advisors in November of 2024 following the acquisition of Buckingham Advisors by Waverly Advisors, LLC. As a Senior Investment Strategist at Waverly, Jim brings more than 20 years of experience in Portfolio Management, Equity Research, Trading, Operations, and Compliance…Learn More

Steve Barrett, CFP®, AIF®, AWMA®, CPWA®, CAP®

Partner and Wealth Advisor

Steve joined Waverly Advisors in January of 2024 after StrategIQ Financial Group was acquired by Waverly Advisors, LLC. He serves as a Partner and Wealth Advisor at Waverly and brings 30 years of experience in Financial Planning to the firm…Learn More

IMPORTANT DISCLOSURES

THE INFORMATION PRESENTED IN THIS DOCUMENT IS FOR GENERAL INFORMATIONAL AND EDUCATIONAL PURPOSES, AND IS NOT SPECIFIC TO ANY INDIVIDUAL’S PERSONAL CIRCUMSTANCES. NOTHING IN THIS DOCUMENT CONSTITUTES, OR SHALL BE RELIED UPON AS INVESTMENT, LEGAL, OR TAX ADVICE TO ANY PERSON. THE INFORMATION IN THIS DOCUMENT IS PROVIDED EFFECTIVE AS OF THE DATE OF ITS PUBLICATION, DOES NOT NECESSARILY REFLECT THE MOST CURRENT STATUS OR DEVELOPMENT, AND IS SUBJECT TO REVISION AT ANY TIME. INVESTING INVOLVES RISK, AND PAST PERFORMANCE DOES NOT NECESSARILY PREDICT FUTURE RESULTS. NONE OF WAVERLY, OR ANY OF ITS OFFICERS, MEMBERS OR AFFILIATES, IN ANY WAY WARRANT OR GUARANTEE THE SUCCESS OF ANY ACTION THAT ANYONE MAY TAKE IN RELIANCE ON ANY STATEMENTS OR RECOMMENDATIONS IN THIS DOCUMENT.

WAVERLY ADVISORS, LLC (“WAVERLY”) IS AN SEC-REGISTERED INVESTMENT ADVISER. A COPY OF WAVERLY’S CURRENT WRITTEN DISCLOSURE BROCHURE AND FORM CRS (CUSTOMER RELATIONSHIP SUMMARY) DISCUSSING OUR ADVISORY SERVICES AND FEES REMAINS AVAILABLE AT HTTPS://WAVERLY-ADVISORS.COM/. YOU SHOULD NOT ASSUME THAT ANY INFORMATION PROVIDED SERVES AS THE RECEIPT OF, OR AS A SUBSTITUTE FOR, PERSONALIZED INVESTMENT ADVICE FROM WAVERLY ADVISORS, LLC (“WAVERLY”). THIS INFORMATION SHOULD BE USED AS A REFERENCE ONLY. TALK TO YOUR WAVERLY ADVISOR, OR A PROFESSIONAL ADVISOR OF YOUR CHOOSING, FOR GUIDANCE SPECIFIC TO YOUR SITUATION. PLEASE NOTE: THE SCOPE OF THE SERVICES TO BE PROVIDED DEPENDS UPON THE NEEDS OF THE CLIENT AND THE TERMS OF THE ENGAGEMENT.