Inheritance and Tax Planning: The Changing Landscape of Qualified Opportunity Zones

Updated 2025 Insights on Deferring, Reducing, and Managing Capital Gains

Introduction

Since their introduction in 2017, Qualified Opportunity Zones (QOZs) have offered investors a way to align long-term capital with community development. The program’s intent remains clear: incentivize private capital to flow into under-resourced neighborhoods while providing significant tax advantages to investors.

But much has changed. Recent legislation and IRS guidance have extended, expanded, and in some cases reshaped how QOZs function. Today’s QOZ environment — sometimes referred to as “OZ 2.0” — introduces new provisions for rural zones, updates to investment timelines, enhanced reporting requirements, and a longer runway for investors to defer or reduce taxable gains. These changes make it essential for wealth holders and families to revisit QOZ planning in 2025 and beyond.

What Is a Qualified Opportunity Zone?

A Qualified Opportunity Zone is a census tract designated as economically distressed, meeting specific poverty or income thresholds. Currently, more than 8,700 tracts across the United States, Washington, D.C., and U.S. territories are designated as QOZs, representing communities home to over 35 million Americans¹.

Once designated, a tract remains a QOZ for a 10-year period. Starting in 2027, new tracts may be nominated, with designations resetting on a 10-year cycle². This framework ensures that Opportunity Zones remain tied to evolving community and demographic needs.

Qualified Opportunity Funds (QOFs)

Investors cannot invest directly in a QOZ. Instead, they must invest through a Qualified Opportunity Fund (QOF), a corporation or partnership organized for the purpose of investing at least 90 percent of its assets into Qualified Opportunity Zone Business Property (QOZBP).

QOF compliance requires semi-annual testing to ensure adherence to the 90 percent standard. The IRS allows working capital to count as QOZBP under certain conditions, provided there is a documented plan to deploy those assets within 31 months into qualifying projects. This flexibility allows for large-scale, multi-year developments to proceed while maintaining eligibility.

Updated Rules for 2025 and Beyond

Recent legislative and IRS updates significantly reshape the QOZ landscape:

- Extended Timeline and Permanence The previous December 31, 2026 deadline for deferral has been eliminated, making the QOZ incentive permanent².

- Investment Recognition and Basis Adjustments For investments made after 2026, deferred gain is recognized at the earlier of (i) disposition or (ii) five years from investment. Investors may still receive a 10% basis increase at year five. For certain rural investments, enhanced basis increases of up to 30% are possible³.

- 10-Year and 30-Year Horizons As before, gains on appreciation of QOF investments may be eliminated if held for at least 10 years. Additionally, investments made post-2026 may qualify for a step-up in basis to fair market value at the 30-year anniversary³.

- Rural Opportunity Zone Incentives A new category of Qualified Rural Opportunity Funds (QROFs) has been introduced. For rural QOZs, the substantial improvement requirement has been reduced from 100% to 50%, lowering the threshold for development and renovation projects³.

- Redesignation and Anti-Gentrification Provisions Beginning in 2027, the eligibility test for designating new QOZs will tighten: the median family income threshold shifts from 80% to 70% of area median, and certain “contiguous tract” rules are repealed². Tracts exceeding 125% of area median income will be excluded, reflecting a stronger anti-gentrification focus².

- Enhanced Reporting Requirements Both QOFs and QOZ businesses face new compliance obligations. IRS Section 6039K introduces additional reporting designed to ensure accountability, transparency, and measurable community impact³.

Investment Timeline Overview

Under the updated OZ 2.0 framework, the QOZ timeline emphasizes milestone-based benefits.

- At the five-year mark, investors may qualify for a 10% basis increase.

- After ten years, appreciation on QOF investments may be fully excluded from taxable income.

- And for post-2026 investments, a new 30-year fair market value step-up may apply, providing extended flexibility and estate planning opportunities.

This structured timeline helps investors align long-term investment goals with evolving tax advantages.

Potential Tax Benefits

QOF investments may continue to provide significant advantages:

- Deferral of Capital Gains Taxes on reinvested capital gains can be deferred until disposition or, for post-2026 investments, for up to five years.

- Reduction of Recognized Gains A basis increase of 10% is available after a five-year hold, with enhanced adjustments in certain rural QROFs.

- Elimination of Future Gains As before, appreciation on QOF investments held for at least 10 years may be excluded from taxable income.

Illustrative Comparison

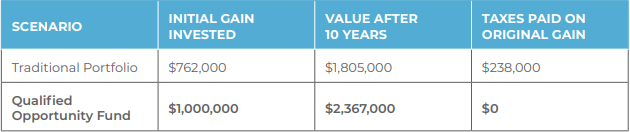

A hypothetical scenario compares a traditional portfolio with a Qualified Opportunity Fund investment:

This illustrates how a QOF structure may preserve more investable capital upfront and, after 10 years, eliminate taxation on appreciation — demonstrating the long-term compounding benefit of deferred and excluded gains.

Implications for Estate and Legacy Planning

For individuals and families with significant wealth, the enhanced QOZ program may serve as a flexible tool in estate planning strategies. Key considerations include:

Trust Structuring

QOF interests may be contributed to certain types of trusts, aligning tax efficiency with intergenerational wealth transfer.

Diversification of Illiquid Assets

By redeploying gains from highly concentrated holdings into QOFs, families may address portfolio concentration risks while achieving favorable tax outcomes.

Charitable Integration

QOF investments may be incorporated into philanthropic vehicles — including donor-advised funds or private foundations — to further align capital deployment with values.

Long-Term Wealth Preservation

With elimination of gain after 10 years and potential recognition rules extending to 30 years, QOFs can complement dynasty trust structures aimed at preserving wealth for multiple generations.

Conclusion

Qualified Opportunity Zones have evolved into a permanent, more flexible program with stronger compliance and greater potential integration into advanced tax, estate, and philanthropic strategies. For investors, families, and business owners, 2025 presents an opportune moment to revisit how QOZ planning fits into the broader picture of wealth transfer, legacy creation, and community impact.

Working with a credentialed planner who can balance tax, estate, and investment considerations is critical when evaluating QOZ opportunities.

References

1. IRS — Opportunity Zones Frequently Asked Questions. irs.gov

2. Economic Innovation Group — Opportunity Zones 2.0: Where Things Stand. eig.org

3. Williams Mullen — Big, Beautiful Changes to the Qualified Opportunity Zone Program. williamsmullen.com

If you would like more information about the terms and strategies discussed in this guide, or if you’re ready to explore how they apply to your specific situation, contact Waverly Advisors. At Waverly Advisors, we work with clients to craft customized estate plans that help minimize tax exposure, maximize wealth transfer efficiency, and ensure financial security for future generations. Whether your goal is to pass down a business, protect an investment portfolio, or establish a charitable legacy, our team can develop a plan tailored to your needs.

MEET THE AUTHOR

Steven M. Gronceski, CFP®, AIF®

Partner, Wealth Advisor

Steve joined Waverly Advisors in January of 2024 after StrategIQ Financial Group was acquired by Waverly Advisors, LLC. He serves as a Partner and Wealth Advisor at Waverly. Steve brings 25+ years of experience to Waverly. He is an experienced high-net-worth investment advisor, with a focus on business owners, corporate executives and professionals…Learn More

IMPORTANT DISCLOSURES

Waverly Advisors, LLC (“Waverly”) is an SEC-registered investment adviser. A copy of Waverly’s current written disclosure Brochure and Form CRS (Customer Relationship Summary) discussing our advisory services and fees remains available at https://waverly-advisors.com/. Please Note: The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. You should not assume that any information provided serves as the receipt of, or as a substitute for, personalized investment advice from Waverly Advisors, LLC (“Waverly”). This article reflects information available at the time it was written and should be used as a reference only. Talk to your Waverly advisor, or a professional advisor of your choosing, for the most current information and for guidance specific to your situation.