Is This the Most Overvalued Stock Market in History?

“Valuation changes rewarding cheap stocks and punishing expensive ones is one of the most powerfully recurring features of global equity markets.” – Dan Rasmussen, The Humble Investor

By any historical measure, U.S. large cap stocks are expensive. Some experts say this is the most overvalued market in history.

Does that mean a correction is imminent? No.

Does that mean the gains will continue uninterrupted? Probably not.

We unpack what elevated valuations have historically meant for future returns, investor behavior, and what humble investors can do to protect themselves.

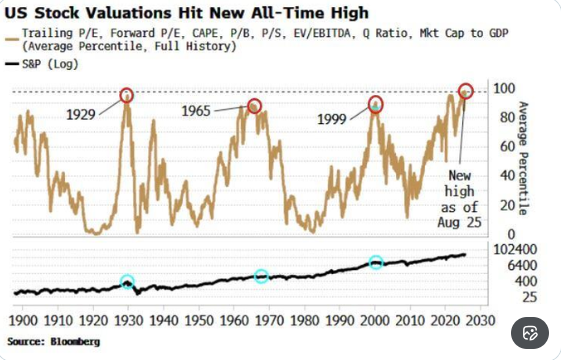

Source: Lukas Ekwueme, X @ ekwufinance

The above graph shows eight different valuation metrics (average percentile ranking) over the past 100+ years (yellow line). The aggregate of the current readings (as of late 2025) shows today’s market could be the most expensive in history.

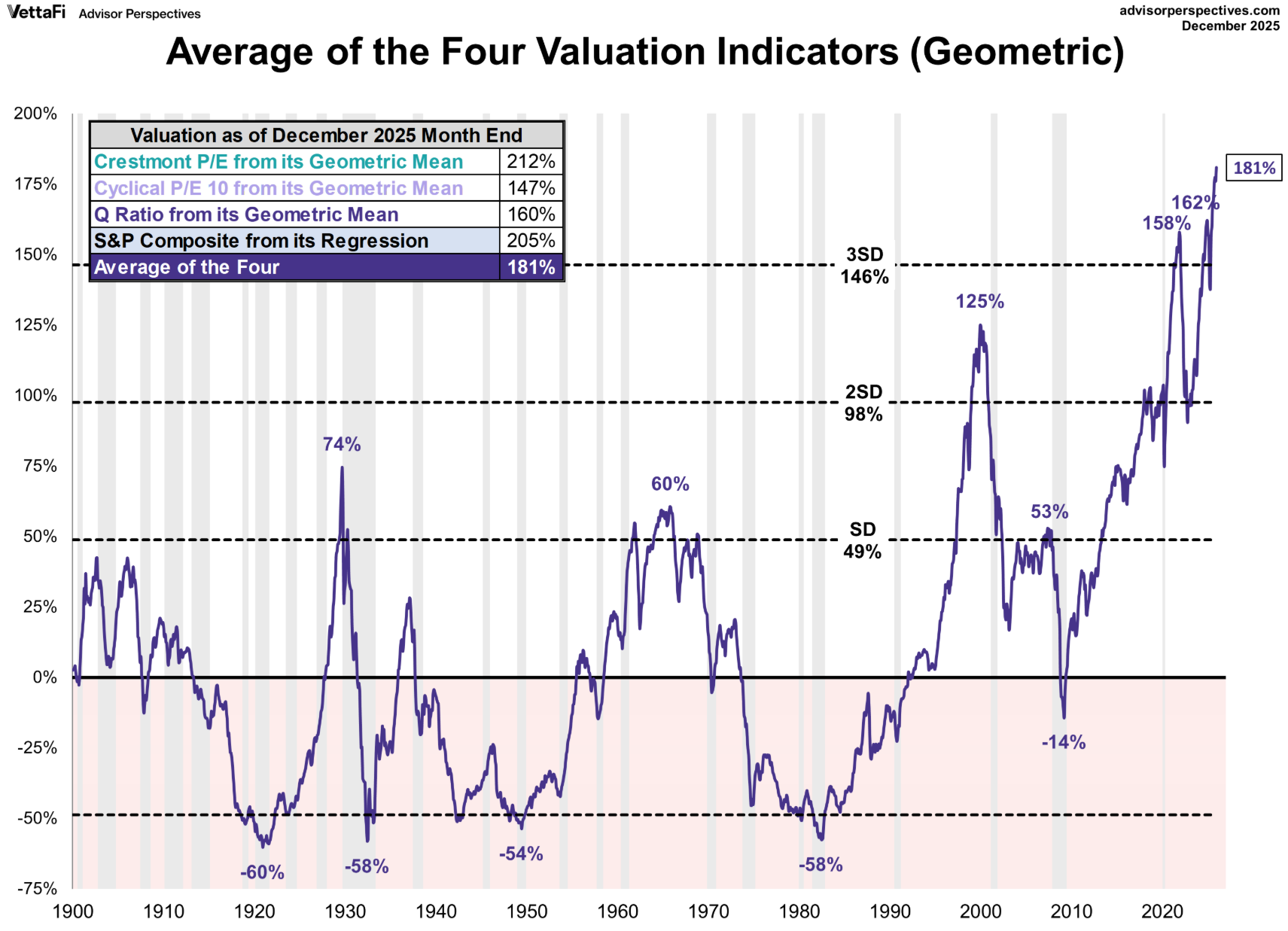

This chart from VettaFi / Advisor Perspectives tracks how expensive the U.S. stock market is relative to its own history using a composite of four valuation measures (the higher %, the more expensive).

Source: VettiFi, Advisor Perspectives

The above graph shows the geometric mean of several valuation metrics for the S&P 500 (as of 12/2025). When valuations are elevated, forward long-term returns are usually lower.

Even for the staunch optimist, we can probably agree stocks are expensive.

What does that mean for future returns?

Nothing in the short run.

Potentially everything in the long run (5+ years).

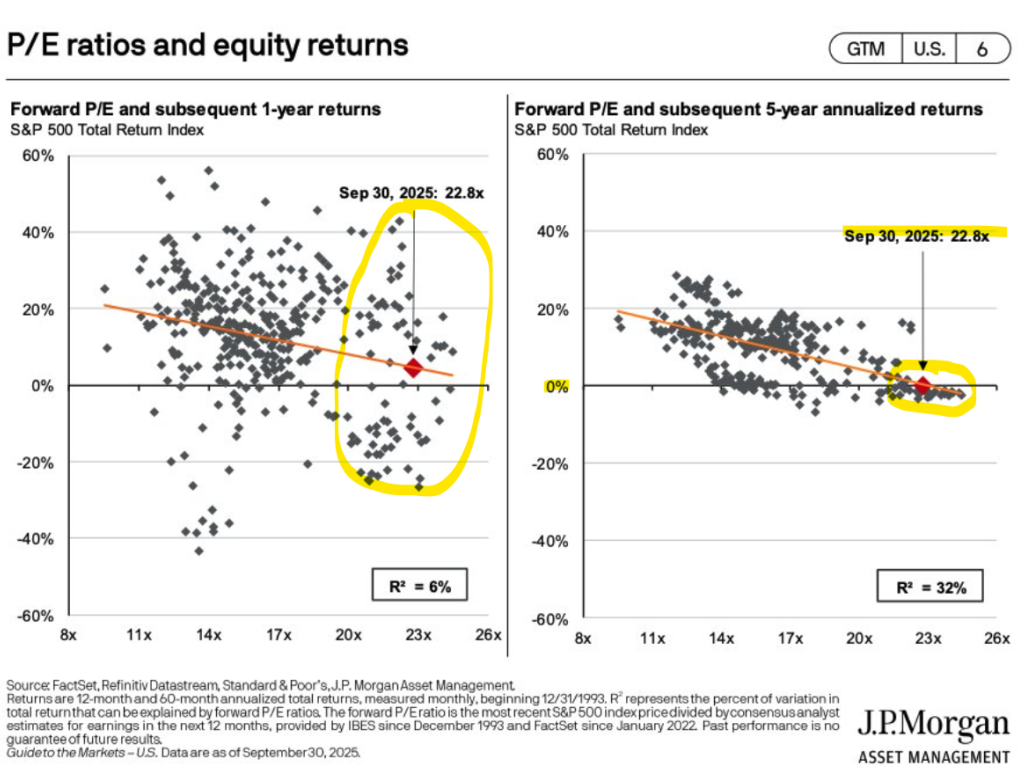

Source: J.P. Morgan Asset Management

The above graph shows forward P/E and subsequent 1-year returns (left graph) and forward P/E and subsequent 5-year returns (right graph, as of 9/30/2025). The graph on the left shows returns followed a random walk over the course of the following year when valuations were elevated (big yellow circle). The graph on the right shows longer term returns (5+ years) clustered around 0% per year when valuations were historically stretched.

We might conclude that valuation is a lousy timing tool over the short term, but quite a powerful predictor of future returns in the long term.

High valuations don’t predictably cause crashes, but they do set up investors for disappointment.

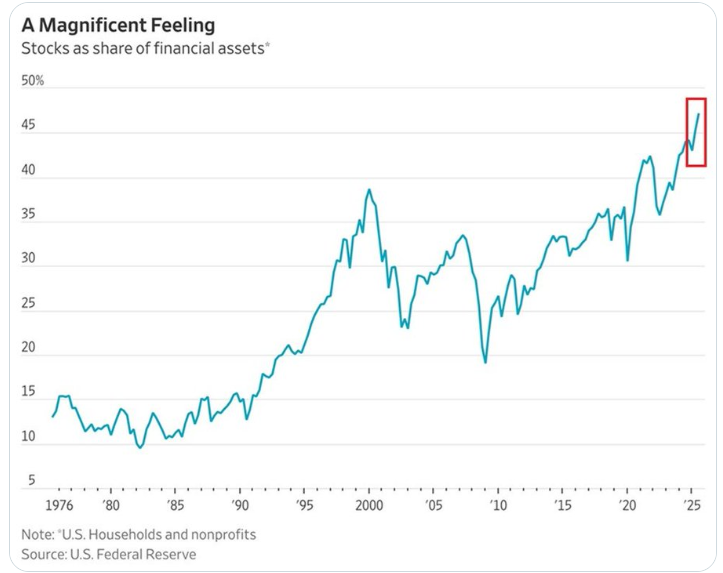

U.S. household are All-In Stocks

The above graph shows the stocks as a percentage of financial assets for U.S. households and non-profits. U.S. investors are the most over-allocated to stocks going back to 1976.

What’s the problem with U.S. households owning stocks?

Nothing, however, cycle peaks in ownership usually signal lower future returns for equities.

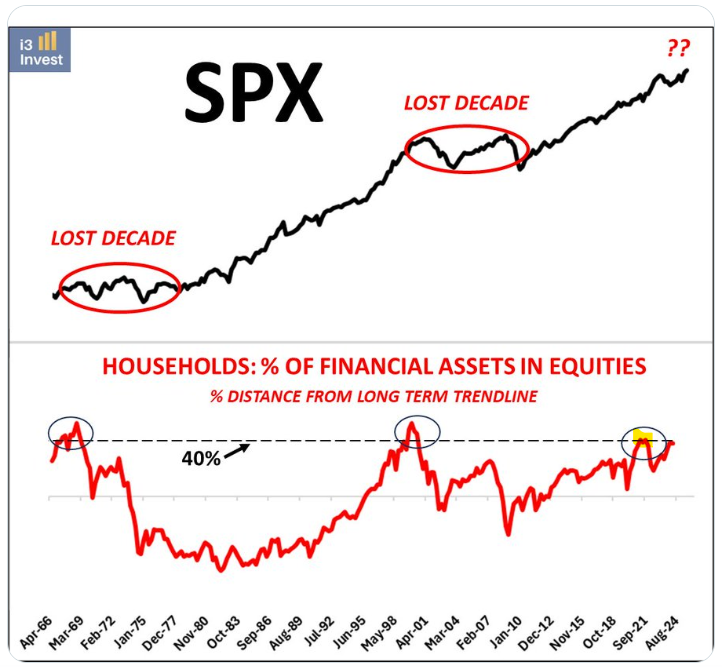

Source: i3 Invest

The above graph shows the S&P 500 (top) and U.S. households’ percentage of financial assets in equities (bottom). When U.S. households crowd into stocks, future returns are challenged over the following decade.

In our opinion, historically expensive markets do not foreshadow impending doom. The investor behavior that comes with runaway stock prices does warrant some caution.

When an asset class or area of the market works, it usually brings in hubris, delusion, overconfidence, and a belief that we can’t miss, which is not a good trait for an investor.

When investing seems easy, when folks are posting their 401k balances online, and threats appear gone—you get some of the most reckless allocation decisions from investors.

In our experience, the illusion of safety often plants the seeds of future instability.

How can we prepare for whatever happens next without playing the market oracle?

- Rather than trying to time when the market is going selloff, a better approach is to ask yourself, “Where am I fragile? How can I reduce my fragility?”. This is turning the lens inward and focusing on what you can control; paying down debt, running your financial plan with lower future returns, dialing in spending, etc.

- Rebalance – it’s a great time to balance out crowded positions and revisit your asset allocation targets.

- Look beyond the S&P 500, Nasdaq (QQQ), and technology stocks. The investment universe extends beyond U.S. markets. In our opinion, most other equity asset classes & factors i.e. international, emerging markets, value, small cap, etc. are more attractively valued vs. U.S. large caps.

- Build a portfolio that reflects your investment personality and capacity to take risks. This should be done before the next market event happens (versus taking a bunch of risk and trying to get out of the way after a correction). It’s better to buy an umbrella before it rains.

If you have questions about Waverly Advisors investment process, shoot us a note @ [email protected]

Written by Nik Schuurmans, CFA®

Nik Schuurmans joined Waverly Advisors in January 2026 after Pure Portfolios was acquired by Waverly Advisors, LLC. As Partner and Wealth Advisor, Nik operates using a transparent and pioneering fee structure, to provide a modern wealth management experience for every client. Nik believes access to professional advice should not come with exorbitant fees, misaligned incentives, and conflicts of interest. Learn More About Nik…

Important Disclosure Information – Waverly Advisors (waverly-advisors.com)

Disclosure: Waverly Advisors, LLC (“Waverly”) is an SEC-registered investment adviser. A copy of Waverly’s current written disclosure Brochure and Form CRS (Customer Relationship Summary) discussing our advisory services and fees remains available at https://waverly-advisors.com/.Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Waverly Advisors, LLC, or any non-investment related services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Forward-looking statements cannot be guaranteed. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any information provided serves as the receipt of, or as a substitute for, personalized investment advice from Waverly Advisors.”