Four Basic Financial Skills All Young Adults Should Know

As part of middle school and high school educational curriculums, students typically learn about a variety of subjects, like languages, math, and sciences. However, most aren’t practically taught about money, budgeting, and investing. As most would agree, hindsight is nearly always 20/20 and there are things we wish we could go back in time to tell our 20-year-old selves. While rewriting history isn’t in the cards, we can help shape the future of the young people we love by sharing some practical and easy-to-implement financial skills that can assist in financial success.

Financial Skill #1: Create a Personalized Budget

Budgeting is key to financial success because it effectively allows you to tell your money what to do. This exercise allows you to have the freedom to make informed choices about how you use the dollars you have.

Budgeting involves:

- Understanding your cash flow (money coming into and out of your accounts)

- Tracking your spending (identify needs versus wants)

- Assigning dollar values to your priorities (needs, savings, wants, etc.)

An effective budget will chart your income and expenses so that you conduct your finances wisely and spend less than you earn thus having savings. Most banking institutions now offer a money management tool you can utilize to analyze your spending over time; however, if your bank does not offer this resource then the interactive budgeting tool at Mint.com is an excellent option.

Financial Skill #2: Start Saving Early

Become a disciplined investor early by contributing a portion of every paycheck to either a company-sponsored retirement plan or individual retirement account (IRA) starting with your first job. If participating in a company-sponsored plan, check to see if your employer offers a match on all or part of your contribution, as this additional contribution from your employer is an automatic return on your investment.

Speaking of return on investment, be sure your retirement savings are in fact invested versus sitting in cash. As a young adult who is saving for retirement 30-40 years from now, you have the capacity to be more aggressive with your investment allocation; however, your investment selection is entirely up to you and depends on your appetite for risk.

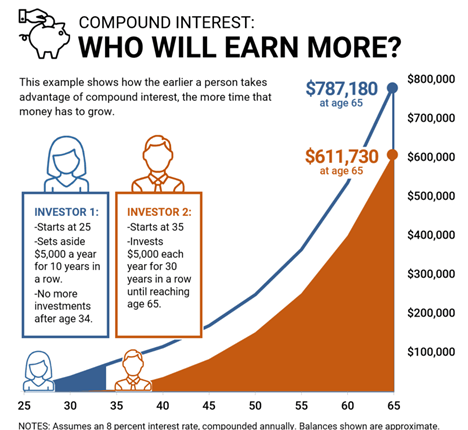

The following chart helps illustrate the benefit of compound interest over time.

Saving and investing on a regular basis from an early age will allow you to take advantage of compound interest which means that as your initial dollar investment grows, your overall balance in your investment or retirement account grows. As your overall balance grows, there is more money to earn market appreciation.

Saving and investing on a regular basis from an early age will allow you to take advantage of compound interest which means that as your initial dollar investment grows, your overall balance in your investment or retirement account grows. As your overall balance grows, there is more money to earn market appreciation.

Financial Skill #3: Understand Credit and How to Build it Responsibly

Establishing and building credit can sound intimidating, or like an activity reserved for someone who is more financially advanced, but the secret to good credit is starting early and being financially responsible. Learning basic lessons about credit cards and interest rates can potentially save you from starting your financial journey on the wrong foot. Credit cards can be a useful tool in building credit, but they can also quickly become a pitfall if not managed adequately.

There are a few fundamental things that all young adults should understand before applying for a credit card:

- You must pay back every dollar you charge.

- Credit card interest accrues daily when you carry a balance.

- Your interest rate can play a huge role in your monthly bill if you aren’t paying off your charges completely each month.

The key takeaway is that credit should be used wisely. When it’s used responsibly, it can go a long way to building a solid financial future. Save for what you want, and only use credit when you’re confident you’ll be able to pay off the charges regularly and, therefore, minimize any accrued interest. For more information about credit card basics, check out the following articles from NerdWallet:

- Ultimate Guide to Understanding Your Credit Score and Score Ranges

- Credit Card Basics for High School Students

Financial Skill #4: Learn How to Write a Check

While check writing may seem old-fashioned to some, the skill certainly still serves a purpose, even in our current world of online banking.

For example, during a young adult’s first independent housing experience, many find that a check will likely be the preferred form of rent payment, among other necessary expenses, so it’s important to know how to write one. This interactive check-writing simulation provides helpful guidance on how to correctly write a check.

Additional Resources on Financial Skills for Students and Young Adults

While this information isn’t intended to be an all-inclusive guidance or resource compilation for financial literacy, it is meant to be a basic springboard of key principles every young adult should know. Below are a few additional digital resources providing more insights on financial literacy:

- MoneySKILL®educates students about the basic understanding of money-management fundamentals. The course includes the content areas of income, expenses, saving and investing, credit, and insurance.

- EVERFIoffers interactive, online financial literacy resources to K-12 schools free of charge.

If you have questions about your specific situation or would like to learn more, contact a member of Waverly Advisor’s financial planning team.

Ashley Tucker serves as a Financial Planning Associate with Waverly Advisors. Click here to learn more about her or to reach out to her directly.

Disclosure: You should not assume that any information provided serves as the receipt of, or as a substitute for, personalized investment advice from Waverly Advisors, LLC (“Waverly”). This article reflects information available at the time it was written and should be used as a reference only. Talk to your Waverly advisor, or a professional advisor of your choosing, for the most current information and for guidance specific to your situation. Please Note: The scope of the services to be provided depends upon the needs of the client and the terms of the engagement. A copy of Waverly’s current written disclosure Brochure and Form CRS (Customer Relationship Summary) discussing our advisory services and fees remain available at https://waverly-advisors.com.