Changes Coming for Itemized Deductions

The provisions in the 2017 Tax Act (the “TCJA”) were enacted as largely temporary provisions to help the legislation comply with budgetary requirements. With the 2017 Tax Act, the projected cost of the law at enactment was a $1.5 trillion increase to the deficit between 2018 and 2027. The current estimate of extending the expiring provisions is a $3.5 trillion increase to the deficit over 10 years.

One of the largest changes under the TCJA was to increase the standard deduction and significantly curtail available itemized deductions. These two provisions changed the way millions of Americans filed and paid taxes over the last 6 years. Without an extension of the provisions, we will revert back to the previous system of deductions.

Standard Deduction

The standard deduction in 2024 for a single taxpayer is $14,600 ($29,200 for joint filers). The standard deduction will revert back to previous levels starting in 2026, adjusted for inflation. The standard deductions in 2017 were $6,350 and $12,700 for single and married taxpayers. A rudimentary estimate of the 2026 numbers would give me approximately $8,000 for single taxpayers and $16,000 for married taxpayers in 2026. Using those estimates, reverting to the lower standard deduction would reduce those automatic deductions by $7,000 ($14,000 for married couples).

State and Local Taxes

State income taxes, sales taxes, and property taxes may be deducted from federal taxable income. Prior to 2018 the amount of the deduction for those taxes was unlimited. Since 2018 the deduction for all state and local taxes paid is limited to $10,000/year. Taxpayers with $300,000 of taxable income at a 4.25% state rate would owe $12,750 in income taxes alone and would likely owe property taxes as well. The $10,000 annual limit has significantly reduced the ability of higher income taxpayers to deduct their state taxes. The estimate of the percentage of taxpayers benefitting from the state and local deduction fell from 25 percent in 2017 to 10 percent in 2018. The benefit amount fell even more dramatically, with the benefit to individual taxpayers falling 75 percent from 2017 to 2018!

Mortgage interest deduction

Prior to 2018 taxpayers could deduct interest paid on qualifying mortgages on first and second homes of up to $1,000,000. Since 2018 the limit on deductible debt was reduced to $750,000. That number will increase back to $1,000,000 in 2026. The estimate of the percentage of taxpayers benefitting from the mortgage interest deduction fell from 20 percent in 2017 to 8 percent in 2018. The benefit amount for Mortgage interest fell by roughly two thirds from 2017 to 2018.

Miscellaneous deductions

These were largely eliminated under the TCJA but will spring back into life in 2026. Impacted deductions include personal casualty and theft losses, gambling losses, unreimbursed employee expenses, and tax preparation fees.

In addition, moving expenses not paid by an employer will be deductible again starting in 2026. Note that the moving expense deduction is not a part of itemized deductions but is an “above the line” deduction from gross income.

Overall limitation on itemized deductions

If you itemized deductions prior to 2018, you may have run into the overall limitation on those amounts. Also known as the “Pease limitation,” high income taxpayers must reduce their itemized deductions by 3% of income over a certain amount of gross income ($261,500 for single filers and $313,800 for joint filers in 2017). The overall limitation may not reduce deductions by more than 80%. For the examples below I am assuming an inflation adjusted AGI limitation of $329,500 in 2026.

Examples

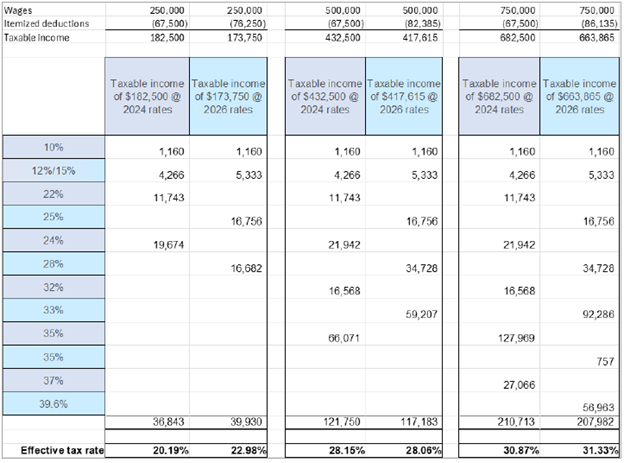

Let’s look at a couple of examples of how the interaction between revised marginal rates and the changes to itemized deductions might play out.

We will assume a single taxpayer at various income levels (wages of $250,000, $500,000, and $750,000) paying state income tax at 4.5%, property taxes of $5,000, with a home mortgage of $800,000 at 5% (current year interest of $40,000), and charitable contributions of $20,000. These are estimated numbers only, as inflation-adjusted brackets and limitations for 2026 have not been released.

As you can see from the examples, the taxpayer at $250,000 and $750,000 in wages pays a higher tax bill after the “tax cuts” expire while the taxpayer at $500,000 in wages would have a lower tax bill after the expiration. This is almost exclusively driven by the increased deduction for state and local taxes after 2025. At $250,000 in earnings the increase in rates is more pronounced and the taxpayer pays higher taxes of 2.8%.

These are very simplified examples and do not reflect other changes that may or may not occur, including the return of the personal exemption, the changes to the health insurance premium tax credit, the pass-through deduction for qualified business income, changes to the child tax credit, lower exemptions for AMT, and many more.

My message remains the same, the tax legislation that was enacted in 2017 made a lot of adjustments to our U.S. tax system. Depending on your specific facts, the expiration of those provisions may be more or less favorable to you, but it may not be as dramatic a difference as you might think. To get an accurate idea of the impact of taxes on your finances it’s important to have an updated financial plan that incorporates the new (old) tax rules. Contact your advisor to discuss the impact on any planning that may need to be revisited or refreshed.

Meet the Author

Becky Hoover

CFP®, CPA, CDFA®

Partner, Wealth Advisor

You should not assume that any information provided serves as the receipt of, or as a substitute for, personalized investment advice from Waverly Advisors, LLC (“Waverly”). This information should be used as a reference only and is not intended to provide tax or legal guidance. Talk to your Waverly advisor, or a professional advisor of your choosing, for guidance specific to your situation. The achievement of any professional designation, certification, degree, license, membership in any professional organization, or any amount of prior experience or success should not be construed by a client or prospective client as a guarantee that he/she will experience a certain level of results or satisfaction if Waverly Advisors, LLC is engaged, or continues to be engaged, to provide investment advisory services.