Frequently Asked Questions about Estate Planning for Digital Assets

For decades, property has been classified into two categories: real and personal. Now, with the increasingly digital nature of our society, we have a new category of assets that need to be planned for: digital assets.

What is a Digital Asset?

While there is no universally accepted definition, a digital asset can simply be thought of as information stored on a computer, smart device or in the cloud. Just like traditional property (real and personal), digital assets have both monetary and sentimental value.

If you use a computer, you probably have digital assets like email accounts, financial accounts, photo and video sharing accounts and social media accounts.

Why is Estate Planning for Digital Assets Important?

Because of the amount of data stored electronically, planning for digital assets is just as important as planning for tangible ones.

Many people receive their bills and monthly statements online. How will your executor know what bills to pay if they don’t have access to your email?

What will happen to all the photos and videos you have saved in the cloud if you don’t give someone access? Those are memories your family will definitely want to keep after you are gone.

How is Estate Planning for Digital Assets Different Than Estate Planning for Traditional Assets?

Planning for digital assets can be much trickier than planning for traditional ones. The law is constantly trying to catch up with societal and technological advancements, and digital assets are no exception.

Because user agreements are between the user and the company, gaining access to a deceased’s information and account is often extremely difficult. In response, online companies have begun to develop their own policies and procedures to address the issue.

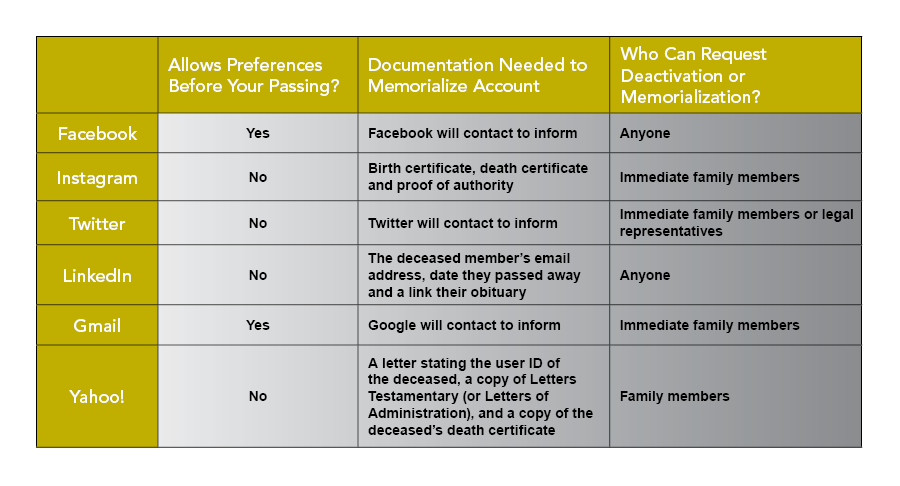

Policies vary by platform, but here’s a summary of several common digital assets and their policies for deceased user accounts. While this certainly isn’t an exhaustive list, it’s a helpful place to begin understanding digital assets and the part they play in estate planning.

Facebook/Messenger:

You can either:

- Appoint a legacy contact to look after your memorialized account; or

- Permanently delete your profile

If you do not affirmatively choose to have your account deleted, Facebook will memorialize your page once they learn of your passing.

To appoint a legacy contact to look after a memorialized page, go to: Settings > Memorialization Settings > Choose a Friend > Add. The steps to remove someone as your legacy contact are the same but choose “Remove” instead.

To have your account deleted after your passing, go to: Settings > Memorialization Settings > Request that your account be deleted after you pass away > Delete After Death.

Unlike Facebook, Instagram doesn’t have a way for you to dictate what happens to your account upon your passing. However, Instagram will memorialize an account once they receive a valid request, which requires proof of death.

To remove an account, an immediate family member must submit a formal request and include copies of the account owner’s birth certificate, death certificate and proof of authority under local law that the requesting family member is the lawful representative of the deceased or his/her estate.

Immediate family members or legal representatives of a deceased’s estate may request deactivation of an account by completing a privacy form. Once the form is submitted, Twitter will contact you with further instructions for how to proceed and information they need submitted.

LinkedIn allows for anyone to report the passing of an account holder and requires a report to be completed. This report will ask you for the following information: the deceased’s name, URL to their LinkedIn profile, your relationship to them, the deceased member’s email address, date they passed away and a link to their obituary.

Gmail

You can make your own plans for your account through Google’s “Inactive Account Manager.” Here, you will decide how long your account must be inactive before Google will notify a person of your choosing and share your data with them. Also, you will have the option to permanently delete your account once it is deemed inactive.

If a deceased account holder did not make plans for his or her account through the Inactive Account Manager, Google will work with the immediate family of the deceased to close the account when appropriate. In certain circumstances, Google will share content from a deceased user’s account after careful review.

Yahoo! Mail

Yahoo! Mail does not have a way for you to dictate what happens to your account at your death like Gmail does. Instead, your family may request that Yahoo! close the account after specific documentation is submitted:

- a letter stating the user ID of the deceased,

- a copy of Letters Testamentary (or Letters of Administration) and

- a copy of the deceased’s death certificate.

How Do You Best Plan for Digital Assets?

Some people make a list of their accounts, usernames and passwords and keep them in a secure location. This is one way to provide access to your family at your passing, but it can also be troublesome if the wrong person finds the information. Others have subscribed to password management services to securely store their information. You will find some services charge for storage, while others are free.

Regardless of the route chosen, one thing is clear—these assets must be planned for. Connect with your estate planner for guidance about the best option for your specific digital assets. For assistance from Waverly Advisors, connect with your advisor directly, or ask a member of our team to reach out to you.

Disclosure: You should not assume that any information provided serves as the receipt of, or as a substitute for, personalized investment advice from Waverly Advisors. This information should be used as a reference only. Talk to your Waverly Advisors, or a professional advisor of your choosing, for guidance specific to your situation. Waverly Advisors is not affiliated with any vendor mentioned in this article. Waverly Advisors is not a sponsor to the vendors and is not compensated for recommending, or sharing information on the vendors. None of the vendors compensate Waverly Advisors for marketing or other purposes.