GDP Report Is In: What’s Next For Our Economy?

Earlier today, the Bureau of Economic Analysis (BEA) reported that the initial reading of 2nd Quarter Gross Domestic Product (GDP) was 4.1%. The GDP report represents the most important barometer for the health of our economy, and the just-released report is not only the strongest quarterly number since 2014, but it also indicates one of the best growth rates in the last 10 years. While it was quite common to have 4% GDP reports during the mid-to-late 1990s, anything above 3.5% has been somewhat elusive since the turn of the century, due to a declining labor force (mainly demographics) and sub-par productivity. Just for clarification, the BEA releases their report on a quarterly basis, yet it is an annualized, after-inflation number.

The markets should not be surprised by this very strong result since it has been predicted throughout the April to June timeframe as the service sector, manufacturing sector, consumer sentiment and job reports continued to reflect a stronger economy. The tax cuts implemented at the beginning of this year and the continued reduction in burdensome regulations have caused American companies to display a renewed optimism, which has led to stronger profitability. Good news for the economy does not always translate to good news for the stock and bond markets. A robust economy can lead to inflation, which might cause the Federal Reserve to ramp up the interest rate increases that they have been gradually moving higher over the last 2 ½ years. Right now, interest rates and inflation are at a moderate level, which could be positive for stocks and bonds, but the upward trend may lead to some anxiety for nervous investors.

2018 has been a very volatile year for the markets. It started off strong in January, but experienced a 10% decline in February and has been slightly positive, with a lot of fits and starts, through the end of June. The month of July has been strong and somewhat stable, despite the daily updates on Trade War (tariff) discussions among the U.S., China, Europe, Canada and others. Based strictly on the trend in Corporate America’s profitability, a reasonable investor would expect the stock market to be performing better; however, the import tax cloud hanging over the global markets is likely to limit the advances of the Dow Jones and S&P 500 in the near term.

In a nutshell, the strong economic reading is definitely something to celebrate, even if the markets, in the short term, have a different reaction. While it will be difficult to sustain the growth indicated in this 2nd quarter report, many economists believe that 2.5% to 3% is a more realistic expectation. The last recession ended in 2009, so we have now gone nine years without an economic downturn. Historically, a trend such as this does not last as long as it has, but the fact that growth has been somewhat moderate since 2010 likely caused this cycle to be longer. All good things must eventually come to an end. At some point, the economy will start to slow down, the unemployment rate will begin to move higher, and consumer confidence will erode. This is a natural part of the business cycle. Investors need to be prepared for and be patient during the next market downturn. The reason that stocks and bonds produce better results than cash over longer time periods is that they go through short-term periods of underperformance. Our best advice is to let us worry for you, and try to ignore the day-to-day market movements, focusing only on the long-term results.

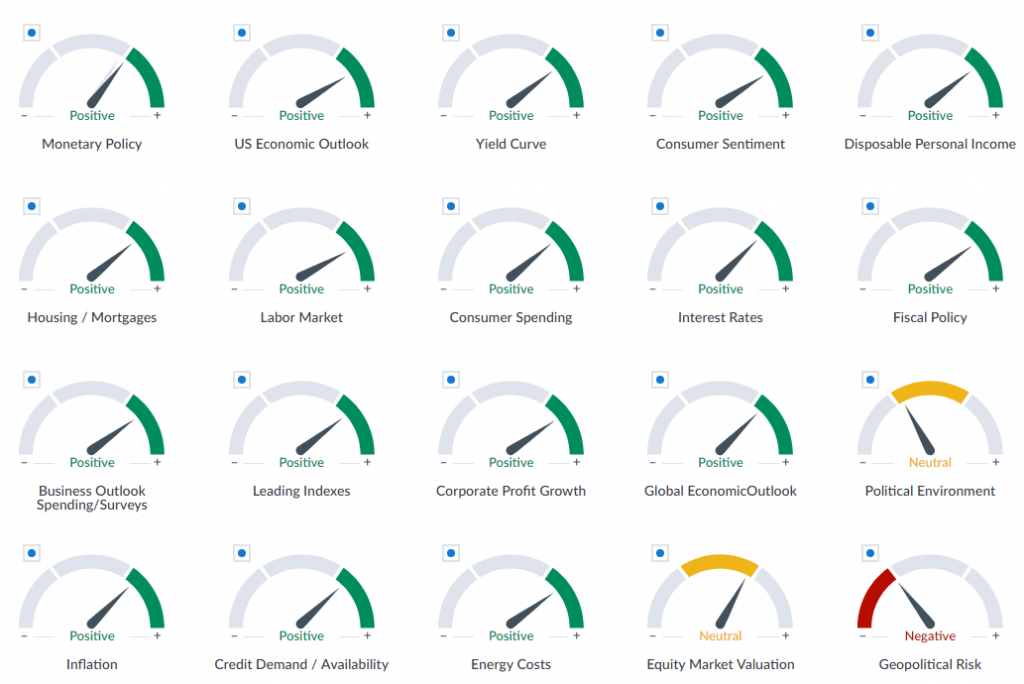

Our friends at City National Rochdale in California permitted us to use their economic/market speedometer model, which covers 20 widely-quoted indicators. As you can see, 17 of them are green, reflecting a positive outlook. Political Environment and Equity Market Valuation are yellow (neutral), while Geopolitical Risk is showing slightly red (negative). What this tells us is the next 12 months are likely to be good for the economy.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Waverly Advisors, LLC, or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Waverly Advisors. Please remember to contact Waverly Advisors, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Waverly Advisors is neither a law firm nor a certified public accounting firm and no portion of the commentary content should be construed as legal or accounting advice. A copy of Waverly Advisor’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request.