When Good News Is Bad News…

Whether it’s solid job creation, rising small business owner sentiment, increasing corporate profits or first quarter GDP growth projections (currently around 4%)*, the U.S. economy is performing well, and there is optimism about the foreseeable future. By almost all accounts, this should be a good environment for investing. Lately, though, the bears have been winning, as they have made the case that this positive news will ultimately result in inflation and higher interest rates. Rates and inflation have been very low since the last recession/bear market about 10 years ago. The fact that they may be trending back to normal levels that are consistent with an economy no longer dependent on the Federal Reserve to have sustainable growth is not necessarily a bad thing. As long as inflation does not spike to levels that would cause an economic slowdown or interest rates don’t rise so much that mortgages and other loans put a damper on consumer behavior, we may look back on this most recent market downturn as a short-term decline in the midst of a long-term upward trend.

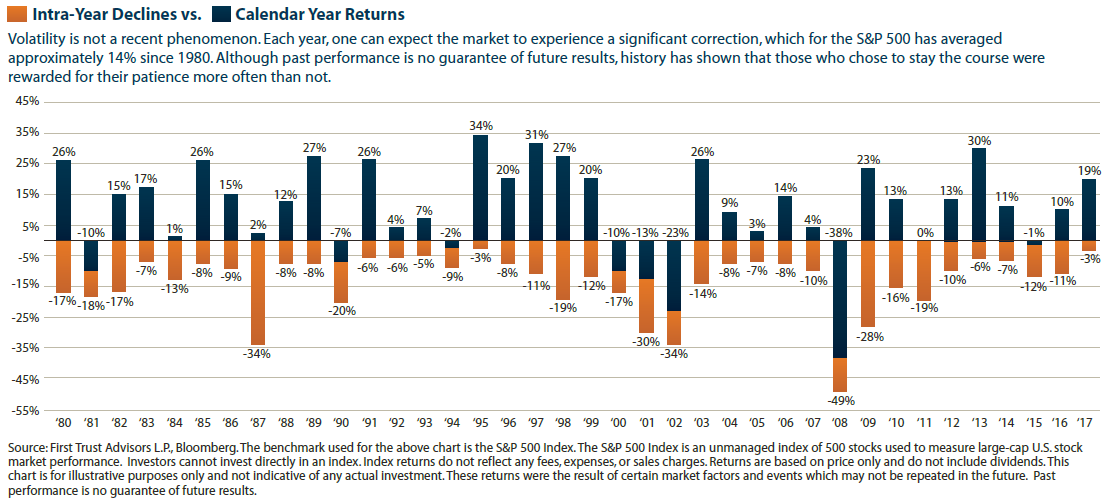

Since the market reached its highest level on January 26, we have now experienced a 10% “correction” in the major averages (Dow Jones and S&P 500). While we haven’t had a correction in about two years, they are not uncommon. In fact, history shows that they occur almost every year, although some years may only experience an intra-year decline of 5-10%. This can be seen graphically in the chart below. The stock market tends to be positive about 75% of the time when viewed on a calendar-year basis (the blue bars), although investors have to be patient and stay the course during temporary downturns (the orange bars) like the current one we are encountering. Investors typically have long-term goals that exceed five years in duration; therefore, the time horizon for achieving market returns needs to also extend beyond five years. When put in that context, the day-to-day, month-to-month or quarter-to-quarter market movements should not be a cause for concern or anxiety. Based on history, the markets should recover just as they did when everything was gloomy in 2008. The key is to have a portfolio allocation that matches your tolerance for risk and to avoid making short-term emotional decisions that may be detrimental to achieving your objectives.

*according to the Atlanta Federal Reserve’s GDPNow forecasting model