Quarterly Review & Market Outlook – 3rd Quarter 2025

“No risk it, no biscuit.”

– Bruce Arians, former NFL head coach

The third quarter began with stimulative policy from Congress and ended with stimulative policy from the Fed. Most asset classes rallied as financial conditions eased. The constraints on the economy this year have been interest rates and tariffs, and neither appears to be especially restrictive. Rates are lower across the board. Tariffs are complex but porous. Roughly half of imports are exempt, including computer components key to the AI capex buildout.

The investment wave in data centers, semiconductors, and power generation is the largest since the railroad boom in the late 19th century. In September, Oracle announced a $300 billion contract to deliver new computing power to OpenAI that will require debt-financed construction today in hopes of future AI revenues. Oracle is making a huge bet, and the market rewarded the stock with its largest one-day gain since 1992.

The challenge facing the US is whether policymakers can coordinate to enable this much spending without spurring inflation. We are building a huge amount quickly after decades of underinvestment. The US built 100+ nuclear reactors in the 70s and 80s and then squadoosh for the next twenty years. It takes time in our fragmented system to find agreement on technical but contentious issues like permitting interstate high-voltage transmission lines. There is a seven-year waiting list for the newest generation of natural gas turbines. Meanwhile, the largest technology companies, driven by survival instinct and supported by new tax incentives, are not waiting around.

These bottlenecks are holding back productivity and forcing the Fed to choose between jobs and inflation. There is a good case for rate cuts, but there is enough smoke in the inflation data to at least raise an eyebrow. This is precisely when Fed independence matters. A credible, independent central bank anchors longer-term expectations through intermittent bursts of uncertainty. The US fared best during the pandemic because the Fed reacted to a generational crisis with equal and opposite force. The subsequent rate hikes did the prior administration no favors, but they kept expectations in check. US net worth has increased a remarkable 50% in the last five years.

Losing Fed independence would not be the end of the world, but it would certainly be the end of an era. The evidence is clear that countries lacking central bank independence have persistently higher inflation and more economic volatility. The US is not there yet, but prudence demands planning for risks that may never materialize. We prepare for risk and pray our effort is wasted just as we buy home insurance and hope we never file a claim.

Market Review

The third quarter was bookended by fiscal and monetary stimulus, which gave investors a green light on risk. The S&P 500 rose 8.1%, with all sectors positive except the defensive Consumer Staples. Small cap stocks rallied sharply (+12.4%) along with other lower quality areas like nonprofitable technology, further evidence of somewhat less discriminate risk-taking.

Developed International rose 4.5% in the quarter. A modestly stronger dollar weighed on returns. Emerging Markets were up 10.7%, led by China. International markets have outperformed this year, largely from an unwinding of the post-election market reaction late last year. Trailing 1-year returns extend back to one month before the election. Over this period, the S&P 500 is up 17%, Developed International 15%, and Emerging Markets 19%. The dollar is around flat.

Within fixed income, high-quality bonds performed well in the third quarter as interest rates came down all along the yield curve. Credit spreads were already tight and got tighter, reflecting strong fundamentals and some degree of investor complacency. We have been positive on credit for several years, but we are more targeted today as the upside in many areas looks mediocre.

∞

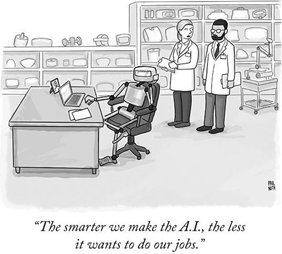

Investing today starts with a decision on AI and the dynamism of the US Technology sector. There are smart investors all along the spectrum from “this is clearly a bubble” to “we are still in the first inning.” Both sides could be right depending on their time horizon.

We agree the pace of innovation is impressive. Companies at the leading edge are growing revenues quickly and have access to a seemingly unlimited supply of capital. They are also locked in an arms race that inspires religious-like fervor, and where the winner is guaranteed nothing. The only thing anyone knows for sure is that winning this race requires galaxy-level sums of cash.

The good news is the depth of capital markets today allows us to benefit without having to place all our chips on red or black. There are more opportunities in more places in a growth-rich reinflationary world. We are leveraging our scale and the depth of our team across every asset class, in public and private markets, to create durable portfolios that can succeed regardless of how the story unfolds.

Thank you for your trust. We look forward to discussing these and any other topics with you.

Written by the Waverly Investment Team

|

|

| Clay McDaniel, CFA®

Partner, Chief Investment Officer |

Important Disclosure Information – Waverly Advisors (waverly-advisors.com)

Disclosure: Past performance may not be indicative of future results. The opinions expressed in this commentary reflect information available at the time it was written and should be used as a reference only. Due to various factors, including changing market conditions, economic conditions, and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Waverly. If you have any questions regarding the applicability of any specific issue discussed above to your individual situation, you are encouraged to consult with your Waverly adviser or the professional advisor of your choosing. A copy of Waverly’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request or by visiting https://waverly-advisors.com/ADV-Part-2A-Brochure. Please see additional important disclosures on the last page of this report.