Quarterly Review & Market Outlook – 4th Quarter 2025

Fourth Quarter Market and Economic Overview

Although 2025 was not the smoothest ride, both the economy and financial markets held up better than many expected. In fact, the US economy has been defying expectations for a while, powering through the Fed’s aggressive rate hikes in 2022 and 2023, and, more recently, sustaining positive growth through tariff uncertainty.

Reported GDP was negative in Q1 as companies rushed to stock up on imported goods ahead of anticipated trade restrictions, but this was a calculation issue, not a sign of actual weakness. As expected, US economic activity rebounded in the next two quarters, perhaps even showing unexpected strength given the imposition of tariffs.

With a backdrop of a resilient economy, rising corporate profits, and sticky inflation, investors kept a close eye on the Federal Reserve to see how they would balance the conflicting goals of a strong labor market and stable prices. After a string of “risk management” rate cuts to close out 2024, the Fed held steady through the early volatility of 2025. The Fed has a difficult job right now. Major policy changes regarding tariffs and immigration mean that normally reliable signals, like slowing job growth, are harder to interpret. As the year progressed, though, there was enough smoke in the jobs data, and enough comfort around inflation, for the Fed to cut rates at each of the final three meetings of 2025.

US stocks were shaky early in the year when many of the technology darlings that led the charge higher in 2023 and 2024 underperformed. This trend gained momentum as the stock market declined sharply in early April when President Trump announced dramatic changes to US trade policy. When he reversed course a few days later, investors quickly discarded their worst-case scenarios and left tariff fears in the rearview mirror. Attention returned to the same themes as before, the resilience of U.S. economic growth, the prospect for interest rate cuts, and the massive investments being committed by leading companies into the development of Artificial Intelligence (AI).

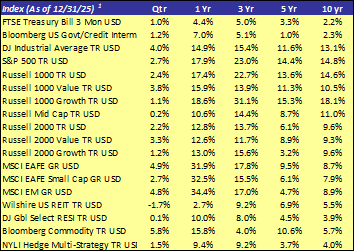

After broad-based gains in prior quarters, the 4th quarter saw investors take a more skeptical view of both the AI opportunity and the path of rate cuts. The S&P 500 index of large-cap US stocks carved a path within a +/-2% range over the course of the quarter, with swings driven, on one hand, by strong earnings, and, on the other, by recognition that not everyone spending on AI is likely to deliver the kind of returns investors are looking for. Combined with a more cautious Fed, the S&P 500 closed out a strong year (+18%) and quarter (+2.5%) with a whimper (-0.1% in December).

While large-cap stocks had another strong year, the breadth of market returns expanded in 2025. In fact, only one of the “Magnificent Seven” stocks were among the S&P 500’s top twenty performers for Q4. None of them made the cut for the full year. In addition, performance was balanced not just across other areas within the large-cap universe, but also among smaller companies that had been left behind in earlier rallies.

Non-US equity markets benefited early in the year as the post-election US rally and dollar strength faded. Significant dollar weakness following Liberation Day widened the gap further. Once the dust settled on tariffs, the US outperformed the balance of the year and the dollar strengthened modestly, but not enough to close the gap on a calendar year basis. Foreign developed stocks (as represented by the MSCI EAFE index) gained nearly +32% in 2025, their strongest showing since the rebound from the Great Financial Crisis in 2009. Emerging Markets stocks (per the MSCI EM index) were even stronger, with sizable gains across underlying markets driving a return for the index of just over +34%.

Fixed income markets were well-behaved throughout the year, coming off a spike in longer-term rates in the final quarter of 2024 driven by a combination of growth optimism and inflation concerns. The US 10-year Treasury yield spent the year moving gradually (and unevenly) lower, supporting positive returns across the global fixed income universe of short- and intermediate-term investment- and non-investment-grade bonds. Long-term interest rates moved slightly higher again in Q4, as the Fed took a more hawkish stance on future rate cuts.

Precious metals were a notable story within the commodities market as gold posted new highs in Q4 alongside dramatic rally in silver and platinum. These impressive gains are often attributed to a number of factors, like currency debasement, but the big picture theories rarely hold up under closer scrutiny. All we can say for sure is there were more buyers than sellers.

Meanwhile, energy prices remained weak, with oil dropping a further -12.5% in the final quarter of the year, as the glut in crude oil persists. For the quarter, the Bloomberg Commodity Index was up nearly +6%, bringing its full year gain to just under +16%.

As you review the market and your portfolio, it’s important to keep sight of your long-term goals, to remain disciplined and diversified, and to ensure your portfolio has been rebalanced towards your strategic targets. We say this a lot; while it is always true, it is likely of even greater importance during unusual times such as these.

1 The Bloomberg U.S. Government Credit Intermediate index is a registered service mark of Bloomberg Finance LP. The Dow Jones Industrial Average is a service mark of Dow Jones & Company, Inc.; the S&P 500 Index is a registered trademark of the McGraw‐Hill Companies, Inc.; the Russell 1000, 1000 Value, 1000 Growth, Mid Cap, 2000, 2000 Value, and 2000 Growth indices are registered trademarks of the Frank Russell Company; the MSCI EAFE and MSCI Emerging Markets indices are registered trademarks of MSCI or its subsidiaries; the Wilshire REIT index is a registered trademark of Wilshire Associates Incorporated; the DJ global Select RESI index is a registered trademark of Dow Jones Trademark Holdings LLC; the Bloomberg Commodity Index is a service mark of Bloomberg Finance L.P.; the IQ Hedge Multi‐Strategy Tracker Index is a trademark of New York Life Investment Management Holdings, LLC

Written by the Waverly Investment Team

Important Disclosure Information – Waverly Advisors (waverly-advisors.com)

Disclosure: Past performance may not be indicative of future results. The opinions expressed in this commentary reflect information available at the time it was written and should be used as a reference only. Due to various factors, including changing market conditions, economic conditions, and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from Waverly. If you have any questions regarding the applicability of any specific issue discussed above to your individual situation, you are encouraged to consult with your Waverly adviser or the professional advisor of your choosing. A copy of Waverly’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request or by visiting https://waverly-advisors.com/ADV-Part-2A-Brochure. Please see additional important disclosures on the last page of this report.