Second Quarter Market Update: Up, Up and Away!

The U.S. economy continued to grow at full speed in the first half of 2021. Consistent support of the Federal Reserve, adoption of the COVID-19 vaccine and additional stimulus from the government fueled an already strong recovery. However, as the stock market has delivered double-digit returns, questions about valuations, inflation and sustainability come into play. Despite these concerns, the overall economy remains strong and all signs point to a continued recovery in the near term.

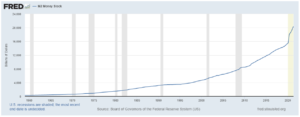

Inflation remains one of the biggest topics of the day. The U.S. government and the Federal Reserve have injected more stimulus into the economy than any other time in history. See figure 1 below—it shows just how much more money is in circulation today than before the pandemic. That figure does not include additional spending and infrastructure bills that are being considered today. This increase in money supply, coupled with back-to-back months of the highest Consumer Price Index (CPI) reports we have seen since August 2008, have economists watching inflation closely.

Figure 1

Should we be concerned about the impact on stocks? Not necessarily, because part of the reason we have had such high CPI numbers is due to energy prices. This time last year, oil reached the lowest it had been in history when an oversupply interacted poorly with capacity issues. This led to prices for oil being negative for a very short period, since no one could find available storage. Today however, with the closing of the Keystone Pipeline, the gradual increase in production from low levels in 2020 and the recent hijacking of the Colonial Pipeline, we are dealing with a supply shortage, which is likely to be temporary. In addition, with the opening of the global economy and increased vaccine adoption, we have seen a surge of consumer activity, particularly in used cars. Both factors have led to a temporary boost to inflation, while longer term indicators such as wage growth, continue to be moderate. Finally, stocks have historically offered some of the best protection against inflation, so even if sustained price increases do take hold, a portfolio that includes stocks is a good place to guard against a reduction in purchasing power.

Now let’s turn to market valuations, which are higher than average mainly due to two positive factors: low interest rates and strong expected earnings growth. Put simply, these factors can justify the investor optimism that is currently pushing markets higher. There are two ways to bring a Price/Earnings ratio to normal levels: The P (price) can come down to reasonable levels or the E (earnings) can rise to meet higher prices. Right now, the E is rising at record levels. In the first quarter of 2021, S&P 500 companies reported earnings growth of 46% in relation to analysts’ initial estimates for the year of 20%. Second quarter results are looking to be above expectations as well, as Goldman Sachs just increased their expectation to growth of 35% for the year, which almost doubles their previous estimate. This is a way for valuations to normalize without a significant price correction.

In terms of the rest of the economy, it is mostly good news. Earnings growth, declining unemployment, stimulus, vaccine adoption, sentiment and many other major economic factors are improving quickly and consistently. Market performance has reflected these positive trends with U.S. stocks represented by the S&P 500 returning 8.6% for the quarter, while international markets represented by MSCI ACWI ex USA gained 5.5%. Even bonds moved higher by 1.8%, despite overall rising interest rates. So, in summary, while we may have some short-term volatility due to inflation and valuations, there is support for asset growth to continue moving up, up and away!

Important Disclosure Information – Waverly Advisors (waverly-advisors.com)