Tax Reform’s Impact on Individual Taxpayers

On December 22, 2017, President Donald J. Trump signed into law “An Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018.” The bill is more commonly known as the, “Tax Cuts and Jobs Act,” and provides the most sweeping changes to the tax code since 1986. This alert will highlight the changes that are relevant for individual taxpayers.

Details

Individual tax reform is temporary. Unless noted, the provisions discussed went into effect on January 1, 2018, and expire on December 31, 2025.

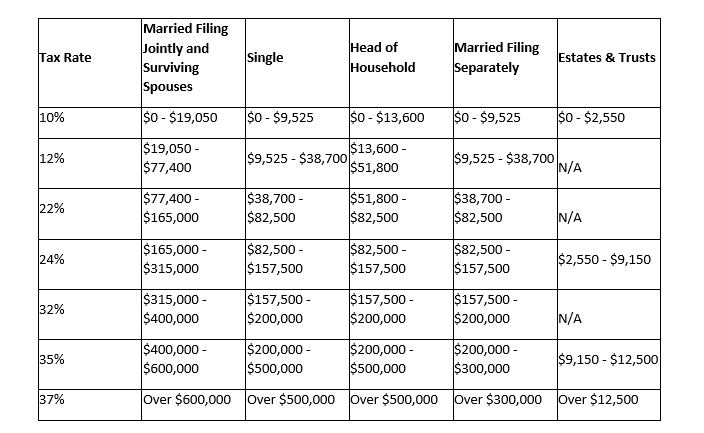

Ordinary Income Tax Rates

The seven-bracket structure was retained; however, the rates were lowered for all taxpayers, with the maximum rate now being 37 percent. The bracket thresholds were raised and will be adjusted for inflation going forward.

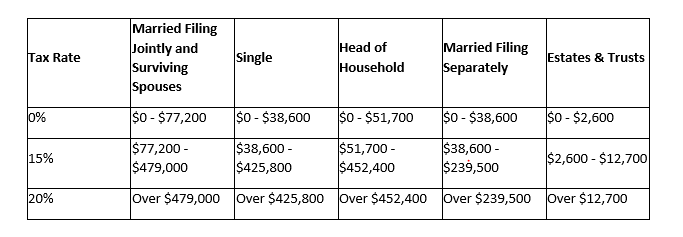

Long-term Capital Gains and Qualified Dividends

Long-term capital gains and qualified dividends tax rates remain unchanged and apply the following rates based on the taxpayer’s taxable income:

Kiddie Tax

A child’s earned income is now taxed at the rates applied to single filers and a child’s net unearned income is taxed at ordinary income and preferential (i.e., capital gains) rates applied to estates and trusts. Accordingly, a child’s income is no longer taxed at the parents’ rate.

Inflation Adjustments

The breakpoints for the ordinary income, long-term capital gains and qualified dividends tax brackets will be adjusted for inflation in future years. However, inflation will be measured using the Chained Consumer Price Index (C-CPI), which generally provides a slower inflationary adjustment than the previous Consumer Price Index (CPI) measurement. This measurement of inflation is applied for all individual tax inflation adjustments permitted in the Act and is permanent; it does not expire in 2025 with the other individual provisions.

Standard Deduction and Personal Exemptions

The standard deduction is doubled to $24,000 for joint filers, $18,000 for head-of-household filers and $12,000 for all other individual filers. The deduction is indexed for inflation in future years. The additional standard deduction for the elderly and the blind was retained.

The deduction for personal exemptions is suspended through 2025; however, the $100 and $300 exemptions for complex and simple trusts, respectively, were retained. The $4,150 exemption for qualified disability trusts was also retained but is to be adjusted to inflation in future years.

Child Tax Credit

The Child Tax Credit was increased to $2,000 per qualifying child, with up to $1,400 being fully refundable. A qualifying child is a dependent child who is under age 17 at the end of the year. The Credit would begin to phase out for joint filers with adjusted gross income exceeding $400,000 and other filers with adjusted gross income exceeding $200,000.

An additional $500 non-refundable credit may be available for other dependents, provided; however, that such additional credit is only available to non-citizen dependents if they are a resident of the United States.

Currently, the Child Tax Credit is $1,000 per qualifying child and is nonrefundable. The Child Tax Credit currently phases out for joint filers with adjusted gross income exceeding $110.000.

Adjustments to Income (“Above-the-Line” Deductions)

Moving Expenses

The new law suspends through 2025, the deduction for moving expenses except in the case of a member of the U.S. military who moves pursuant to a military order. Previously, individuals could take an above-the-line deduction for certain unreimbursed moving expenses incurred by reason of relocating for work.

Alimony

For any divorce or separation agreements entered into after December 31, 2018, the deduction for alimony or separate maintenance payments is repealed. Recipients of alimony or separate maintenance payments will no longer be required to include the alimony payments in their gross income. Under the new provisions, alimony or separate maintenance payments will be treated similar to child support, in that they are not accounted for in the tax system (no deduction and no inclusion). Existing alimony and separate maintenance agreements are grandfathered, as are any modifications to existing agreements unless, however, the parties to a modification expressly provide that the new rules should apply to the modified agreement.

Prenuptial agreements are not grandfathered in, and taxpayers may wish to revisit those agreements in light of these new provisions.

Itemized Deductions

Medical Expense

The medical expense deduction threshold is temporarily lowered to permit a deduction against both the regular tax and alternative minimum tax (AMT) for medical expenses in excess of 7.5-percent of adjusted gross income for all taxpayers itemizing deductions in 2017 and 2018. Previously, the 7.5-percent adjusted gross income threshold was only available for taxpayers over age 65 (younger taxpayers have a 10-percent adjusted gross income threshold), and all taxpayers had a 10-percent of adjusted gross income threshold for AMT purposes.

Taxes

The sum of the itemized deductions for state and local real property taxes, state and local personal property taxes, and state and local income or sales taxes may not exceed $10,000 ($5,000 for married individuals filing separate returns). The deduction for foreign real property taxes is suspended through 2025. The $10,000 limitation does not apply to foreign income taxes paid or real or personal property taxes paid or accrued in carrying on a trade or business.

Further, the new law provides an anti-abuse provision to prevent a deduction in 2017 on the prepayment of state and local income taxes attributable to tax years starting in 2018.

Home Mortgage Interest

The itemized deduction for mortgage interest has been reduced to only permit the deduction for interest paid on acquisition indebtedness not exceeding $750,000 ($375,000 for married filing separate taxpayers) on the taxpayer’s primary or second home. The interest deduction for home equity indebtedness is suspended; however, if the taxpayer’s home equity indebtedness meets the definition of acquisition indebtedness, they may still be able to deduct the interest paid on that line of credit.

Previously, taxpayers could take a combined acquisition and home equity indebtedness interest expense deduction on up to $1,100,000 of debt. Acquisition indebtedness incurred on or before December 15, 2017, is grandfathered and subject to pre-reform limitations. Further, taxpayers who entered into a written binding contract before December 15, 2017, to close on the purchase of a principal residence before January 1, 2018, and who purchase such residence before April 1, 2018, are also eligible for the pre-reform higher limitations.

Charitable Contributions

The Act made three modifications to the charitable contribution rules. First, the percentage limitation for cash contributions to public charities was increased from 50-percent of adjusted gross income to 60-percent of adjusted gross income.

Second, the Act denies a charitable deduction for payments made in exchange for college athletic event seating rights. Previously, taxpayers could deduct 80-percent of amounts paid to an eligible college despite receiving tickets to a collegiate athletic event provided a charitable deduction would have otherwise been allowed had the taxpayer not received event tickets in return.

Finally, the new law repealed the substantiation exception for certain contributions reported by the charitable organization. Previously, taxpayers were not required to obtain a contemporaneous written acknowledgment of contributions in excess of $250 if the donee organization reports the donation on their return.

Casualty Losses

The deduction for personal casualty losses is suspended through 2025 except in the case of losses attributable to a Federally declared disaster. However, taxpayers with a personal casualty loss gain for any taxable year during the suspension period, may continue to deduct personal casualty losses not attributable to a Federally declared disaster in an amount equal to no more than the personal casualty loss gain.

Miscellaneous Itemized Deductions Subject to the 2-percent Floor

All miscellaneous itemized deductions subject to the 2-percent adjusted gross income floor have been suspended. This includes the miscellaneous itemized deductions for investment fees and expenses, tax preparation fees, and unreimbursed employee business expenses among others.

Overall Limitation on Itemized Deductions

The overall limitation on itemized deductions enacted in 1990, often called the “Pease limitation” (named after former Congressman Donald Pease) has been repealed through 2025.

Other Provisions

529 Plans

The new law expands the definition of qualified higher education expenses that may be paid from a 529 account to include up to $10,000 of expenses for tuition at an elementary or secondary public, private, or religious school.

Individual Mandate

The shared responsibility payment for individuals failing to maintain minimum essential health insurance coverage has been reduced to $0 beginning after December 31, 2018.

Like-Kind Exchanges

Beginning after December 31, 2017, nonrecognition of gain from like-kind exchanges is limited to exchanges of real property not held primarily for sale. Transitional relief is provided for exchanges where property was either disposed of or received in an exchange on or before December 31, 2017.

Electing Small Business Trusts (ESBTs)

The new law permits nonresident alien individuals to be a potential current beneficiary of an ESBT.

Further, the charitable deduction rules for ESBTs were modified. ESBTs must now determine their charitable deduction in accordance with the rules applicable to individuals. Accordingly, ESBTs would be subject to the charitable deduction percentage limitations and carryforward provisions of individuals. Their governing instrument is no longer required to include language permitting a charitable deduction.

Individual Alternative Minimum Tax (AMT)

The individual alternative minimum tax (AMT) was retained. However, the exemption amounts were increased to $109,400 for joint filers and $70,300 for single filers. The exemption phase-out thresholds were increased to $1,000,000 for joint filers and $500,000 for single filers. The phase-out threshold for estates and trusts were unchanged. The exemptions and phase-out thresholds are indexed for inflation after 2018.

Estate and Gift Taxes

Beginning in 2018, the lifetime exemption for estate and gift taxes is increased to $10,000,000 (and adjusted forward for inflation after 2011). As a result, taxpayers making gifts, and the estates of decedents dying in 2018 are expected to have an $11,180,000 exclusion amount. The generation-skipping transfer tax exemption amount was also increased and is expected to be $11,180,000 in 2018.

Deduction for Qualified Business Income of Pass-Thru Entities

An individual taxpayer, whether they choose to take the standard deduction or to itemize, may deduct 20-percent of their “combined qualified business income” from a partnership, S corporation, or sole proprietorship, subject to a wage limitation that is phased in for joint taxpayers with taxable income exceeding $315,000 and other taxpayers with taxable income exceeding $157,500.

“Combined qualified business income” includes the taxpayer’s qualified trade or business income, qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership income.

Specified service trades and businesses are generally not eligible for the deduction. However, there are exceptions to permit the deduction for engineering and architecture businesses, and small specified service trades and businesses. Small specified service trades and businesses begin to phase out of the deduction for joint taxpayers with taxable income exceeding $315,000 and other taxpayers with taxable income exceeding $157,500; joint taxpayers completely phase out of the deduction with $415,000 of taxable income, other taxpayers completely phase out at $207,500 of taxable income.

Estates and trusts are generally eligible for the 20-percent deduction.

Business Losses and Net Operating Losses

Business losses are only permitted in the current year to the extent they don’t exceed the sum of taxpayer’s gross income and, for joint filers, $500,000 ($250,000 for all other taxpayers). Excess business losses are disallowed and added to the taxpayer’s net operating loss (NOL) carryforward. Previously, suspended passive activity losses were allowed in full upon the taxable disposition of the passive activity.

Additionally, non-corporate NOL rules now limit deductible NOL carryforwards to the lesser of the carryforward amount or 80-percent of taxable income. Taxpayers are no longer permitted to carryback their NOLs to the previous two taxable years, but they may carryforward their NOLs indefinitely.

Foreign Investments

Individual taxpayers who invest in foreign entities directly, or who invest in U.S. entities that invest in foreign entities, may be subject to additional taxes related to those investments.

Transition Tax

Individuals who own 10% or more in the voting stock of certain foreign corporations (hereinafter referred to as deferred foreign income corporations or DFICs) will be required to include into taxable income, their allocable share of certain earnings accumulated overseas by such DFICs even where no cash or other property is actually distributed.

The transition tax applies to the last taxable year of a foreign corporation beginning before January 1, 2018 and with respect to U.S. shareholders for the tax years in which or within which such tax years of the foreign corporation end (i.e., this transition tax generally should apply for the 2017 tax year with certain exceptions). Taxpayers may elect to pay the transition tax liability over a period of up to eight years (subject to acceleration of payment rules if certain events occur), with the first payment due on or before April 17, 2018. S-corporation shareholders are also generally permitted to elect to defer the payment of the transition tax until certain “triggering events” occur (e.g., the S-corporation liquidates or sells substantially all of its assets).

Global Intangible Low-Tax Income (GILTI)

Under a new anti-deferral provision, U.S. shareholders of controlled foreign corporations must now include in gross income such shareholder’s share of GILTI for the taxable year in a manner generally similar to subpart F income.

The GILTI calculation is quite complex, and GILTI, in general, is very broad reaching, potentially impacting a large number of U.S. shareholders of controlled foreign corporations. GILTI is included by the U.S. shareholders into taxable income as ordinary income. For individual shareholders, the tax rate on GILTI could be as high as 37-percent (the highest marginal individual tax rate).

Domestic C-corporation (other than RICs and REITs) shareholders of controlled foreign corporations, on the other hand, are subject to more favorable tax rules for GILTI inclusions (i.e., a partial deduction and partial indirect foreign tax credit). As a result, individuals with investments in controlled foreign corporations will need to consider the application of GILTI to their structures and may need to consider restructuring their foreign investments.

Insights

The Act provides meaningful changes to the way that individuals, trusts, and estates will be taxed for at least the next seven years (most of the individual provisions are set to expire on December 31, 2025).

The sunsetting of the individual provisions leads to uncertainty in planning for many taxpayers. This is particularly relevant for taxpayers that are considering entity restructuring in light of the fact that the corporate provisions are permanent.

While rates were lowered for all taxpayers, many of the modifications that previously reduced a taxpayer’s taxable income were either modified or eliminated under the new law. This, along with the increase of the standard deduction, will lead to many individuals opting to choose the standard deduction, rather than itemizing their deductions going forward.

The increase in the estate and gift exemption ensures that fewer taxpayers will be subject to the estate tax. However, the sunsetting of the doubled exemption ensures that the traditional estate and gift planning techniques remain relevant for high-net-worth families.

No client or prospective client should assume that this article serves as the receipt of, or a substitute for, personalized advice from Waverly Advisors or from any other investment professional. Waverly Advisors is neither an attorney nor an accountant, and no portion of this article should be interpreted as legal, accounting or tax advice. Waverly Advisors is an independent member of the BDO Alliance USA. This article was borrowed with permission from BDO USA, LLP