How Does Coronavirus Compare? A Brief Look at Historical Market Reactions

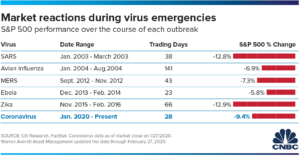

Looking back at the stock market’s historical reaction to major health concerns can provide some perspective in very emotional times. Having said that, past behavior is not always a perfect indicator of how things will play out in the future. Each one of the viruses below was very serious, and there was great uncertainty about how many people would ultimately be affected and how long it would be before a cure was developed. Coronavirus is no exception. As you can see below, the current virus outbreak is still on the shorter end of the length of time in which the market has been impacted (trading days), but it is approaching SARS and Zika in terms of negative performance of the S&P 500 (proxy for U.S stocks). For perspective, let’s consider the chart below published by CNBC that provides an S&P 500 performance comparison for similar virus emergencies:

CNBC.com: “Market reactions to past virus scares show stocks have more to lose.” January 28, 2020.

The good news is that the market has typically rebounded sharply in the 6-month and 12-month periods following the month end of initial impact. On average, the return exceeded 9.0% and 13.0%, respectively, but there had been much volatility around those numbers.

MarketWatch: “How the stock market has performed during past viral outbreaks, as coronavirus spreads to Italy and Iran.” February 24, 2020

In summary, there is no way to predict the length or magnitude of the downturn we are currently experiencing; however, our view right now is that it is not wise to make a big allocation change in an attempt to either avoid further decline or benefit disproportionately from the eventual rebound. If you are positioned properly and have no plans to withdraw a substantial amount of your investment portfolio in the next two to three years, then you should let time be your friend. We will continue to monitor the situation closely and will provide periodic updates as needed.

John B. Cox serves as a Member and as Chief Investment Officer with Waverly Advisors. Click here to learn more about him or to reach out to him directly.