Avoid a “Wimpy” Retirement

Retirement planning and enjoying a successful retirement, in whatever form that is meaningful and enriching for you, requires a committed approach and a high degree of responsibility to produce optimal outcomes. Individuals have differing approaches to saving for retirement, and only a modest percentage of Americans save enough to provide full income replacement during retirement. We spend too much time focusing on “the market” and not enough time focusing on specific steps to improve our rate and consistency of savings.

Let’s discuss the challenge:

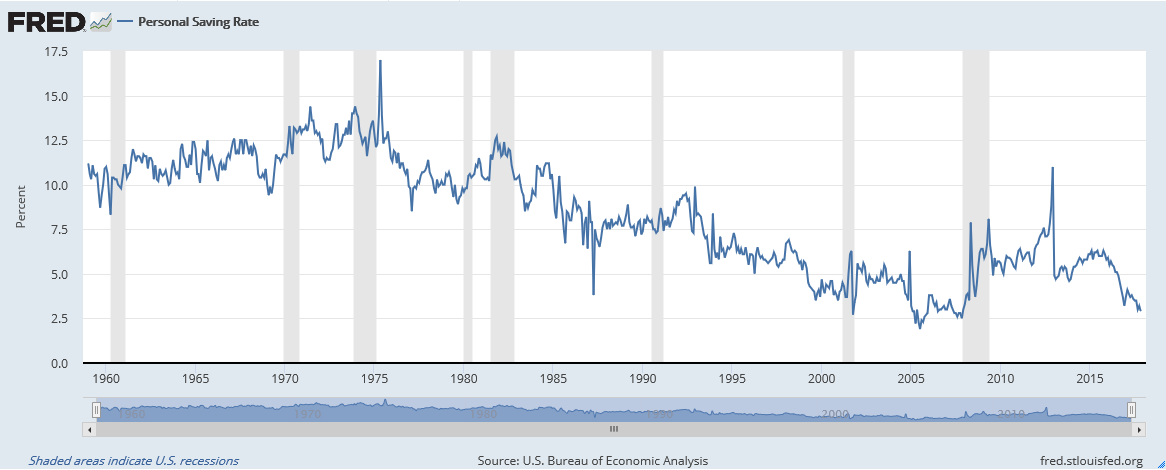

- Americans’ savings rates are paltry.

- Wages are stagnant, in “real,” inflation-adjusted terms.

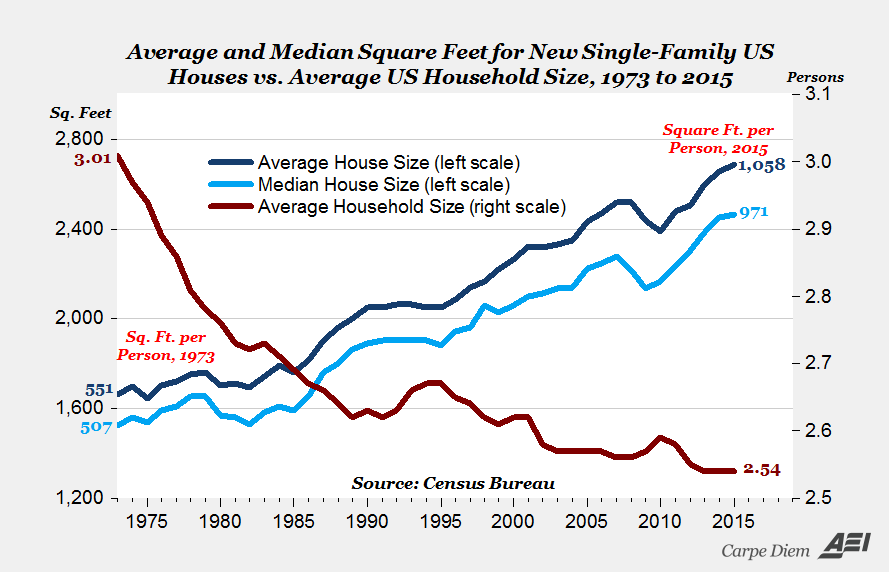

- Home sizes are increasing under the “McMansion” trend.

- Many people find difficulty in setting and completing goals.

- Spending control and personal discipline are challenges for many people.

- We live in a “wimpy” culture in which immediate gratification is emphasized over long-term results. A famous reference to this adage is the old Popeye comic strip, in which the character Wimpy said, “I’ll gladly pay you Tuesday for a hamburger today.”

- Demographic challenges face our social security system and, absent changes, benefits will decline over the next two decades as the wave of baby boomers entering retirement peaks.

Potential solutions are to:

- Begin early and save 10-15% of your income (three to four times the national savings rate).

- Set goals and monitor progress toward your goals (commit to writing).

- Buy a house below your budget, or dump the “McMansion” and downsize now to increase your retirement savings.

- Rein in lifestyle spending.

- Develop a reserve fund.

- Invest your money for growth at a young age.

- Utilize payroll deduction for retirement savings into your employer plan, and increase your contribution annually until you reach the desired deferral percentage.

- Consider a Roth IRA or Roth 401(k) option during your early working years.

- Take advantage of “catch-up” savings provisions in IRA and 401(k) plans at age 50 and above.

With increasing longevity, we must plan for a longer retirement or simply choose to work longer to enjoy what most of us would consider to be a successful retirement. Spreading the “pain” of savings over a 30- or 40-year career and taking your medicine in small doses will greatly increase your chance of not being “wimpy” and enjoying a long, well-lived retirement.