Five Basic Financial Skills All Young Adults Should Know [Plus 11 Helpful Resource Links for Additional Learning]

As part of middle school and high school educational curriculums, students typically learn about a variety of subjects, like languages, math and sciences, but many aren’t practically taught about money, budgeting and investing. While we’re both financial planners now, even we didn’t learn the most basic financial skills until we were living on our own in college. Because we wish we had learned these important skills sooner, we’ve outlined for young adults a quick list of financial skills that we encourage you to adopt.

Financial Skill #1: Budgeting

Budgeting is key to financial success because it effectively allows you to tell your money what to do. This exercise allows you to have the freedom to make informed choices about how you use the dollars you have.

Budgeting involves:

- Knowing your cash flow (money coming into and out of your accounts)

- Tracking your spending

- Identifying (and discerning between) your needs and wants

- Assigning dollar values to those needs and wants

An effective budget will chart your income and expenses so that you conduct your finances wisely and spend less than you earn. Check out these helpful budgeting resources:

Financial Skill #2: Writing a Check

While check writing may seem old fashioned to some, the skill certainly still serves a purpose, even in our current world of online banking.

For example, during their first independent housing experience, many students and young adults find that a check will likely be the preferred form of rent payment, among other necessary expenses, so it’s important to know how to write one. Here are two helpful check-writing resources:

Financial Skill #3: Building Credit

Setting up and building credit can sound intimidating, or like an activity reserved for someone who is more financially advanced, but the secret to good credit is starting early. The following resources provide helpful guidance related to setting up your credit, building your credit score and understanding what impacts your credit over time:

Financial Skill #4: Understanding How Credit Cards and Interest Rates Work

Learning basic lessons about credit cards and interest rates can potentially save you from starting your financial journey on the wrong foot. Credit cards can be a useful tool in building credit, but they can also quickly become a pitfall if not managed adequately.

There are a few fundamental things that all young adults should understand before applying for a credit card:

- You must pay back every dollar you charge.

- Credit card interest accrues daily when you carry a balance.

- Your interest rate can play a huge role in your monthly bill if you aren’t paying off your charges completely each month.

The key takeaway is that credit should be used wisely. When it’s used responsibly, it can go a long way to building a solid financial future. Save for what you want, and only use credit when you’re confident you’ll be able to pay off the charges regularly and, therefore, minimize any accrued interest. For more information about credit card basics, check out this resource by NerdWallet.

Financial Skill #5: Leveraging the Power of Compound Interest

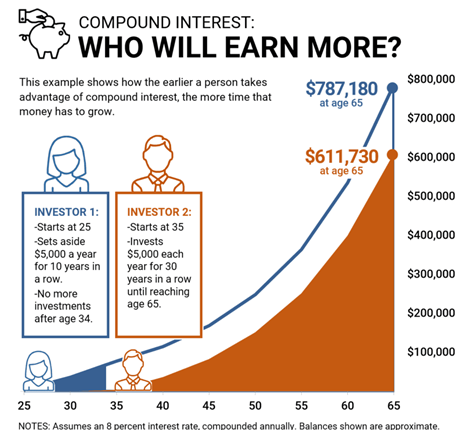

Compound interest means that as your initial dollar investment grows, your overall balance in your investment or retirement account grows. As your overall balance grows, there is more money to earn market appreciation and interest on and your money begins to multiply.

A simple way to determine how long it will take for your initial investment to grow is to apply what’s known as “The Rule of 72.” This rule says to divide your given interest rate on your investment into 72, and the result equals the number of years it will take for your initial investment to duplicate itself. You can read more about the Rule of 72 here.

Additionally, the following chart helps illustrate the benefit of compound interest.

In addition to the helpful links provided above, you can reference these financial resources below:

- Jump$start Clearinghouse offers an online library of financial education resources for students of all ages.

- MoneySKILL® educates students about the basic understanding of money-management fundamentals. The course includes the content areas of income, expenses, saving and investing, credit and insurance.

- EVERFI offers interactive, online financial literacy resources to K-12 schools free of charge.

More Information about Financial Skills for Students and Young Adults

While this information isn’t intended to be an all-inclusive guidance or resource compilation for financial literacy, it is meant to be a basic springboard of key principles every young adult should know.

If you have questions about your specific situation or would like to learn more, contact a member of Waverly Advisor’s financial planning team.

Ashley Tucker serves as a Financial Planning Associate with Waverly Advisors. Click here to learn more about her or to reach out to her directly.

MaryPat Peeples serves as a Financial Planning Associate with Waverly Advisorst. Click here to learn more about her or to reach out to her directly.